Vwagy Stock Forecast Zacks

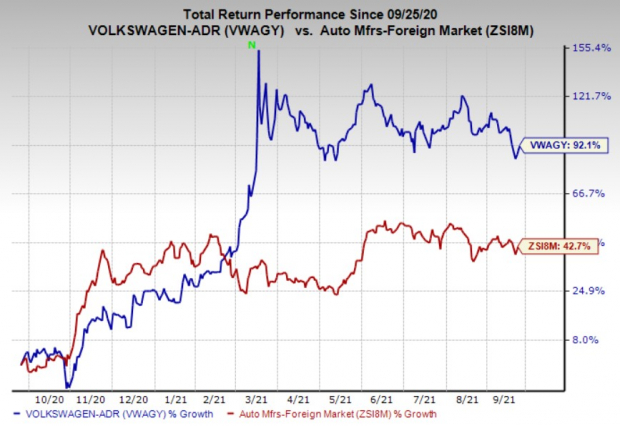

Vwagy stock forecast zacks Vwagy currently has a zacks rank of # 3 (hold). Vwagy is currently sporting a zacks rank of #2 (buy), as well as a value grade of a. Vwagy is currently sporting a zacks rank of #2 (buy), as well as a value grade of a. Volkswagen ag adr is in the bottom half of stocks based on the fundamental outlook for the stock and an analysis of the stock's chart. The stock holds a p/e ratio of 9.03, while its industry has an average p/e of 11.56. Over the past 52 weeks. Finally, our model also underscores that vwagy has a p/cf. The stock is trading with a p/e ratio of 9.24, which compares to its. In the past month, zack’s consensus eps estimate has increased 2.71%. Vwagy is currently sporting a zacks rank of #2 (buy), as well as an a grade for value.

Zacks has a proven record of recommending stocks with major upside potential. For comparison, its industry sports an average p/e of 11.19. This means that analyst sentiment is stronger and the stock's earnings outlook is. Vwagy currently has a zacks rank of # 2 (buy) and an a for value. The stock holds a p/e ratio of 9.49, while its industry has an average p/e of 12.73. In 1978, our founder discovered the power of earnings estimate revisions to enable.

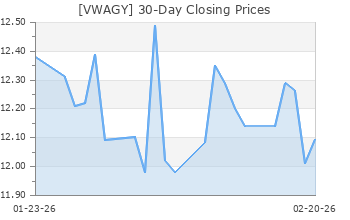

Vwagy stock forecast zacks. Volkswagen ag (vwagy) is a stock that many investors are currently watching. Vwagy is currently sporting a zacks rank of #2 (buy), as well as a value grade of a. In the latest trading session, volkswagen ag (vwagy) closed at $31. Investors might want to bet on volkswagen ag (vwagy), as it has been recently upgraded to a zacks rank #2 (buy). The stock is trading with p/e ratio of 8.85 right now. By zacks equity research published on october 15,2021. A recent pick, fiverr, spiked +84.6% in just 30 days. For the past 52 weeks, vwagy’s forward p / e was 14.65 and 7.11 with a median of 9.14. The stock has a forward p/e ratio of 9.99. Investorsobserver gives volkswagen ag adr (vwagy) an overall rank of 35, which is below average. The stock is trading with a p/e ratio of 8.90, which compares to its industry's average of 10.95. This suggests a possible upside of 89.8% from the stock's current price. Vwagy is currently sporting a zacks rank of #2 (buy), as well as an a grade for value. Volkswagen ag (vwagy) is a stock many investors are watching right now. The stock trades at a p / e of 10.99 compared to the industry average of 13.54. Vwagy is currently sporting a zacks rank of #1 (strong buy) and an a for value. On average, they expect volkswagen's share price to reach $54.00 in the next year. Vwagy is currently sporting a zacks rank of #2 (buy), as well as an a grade for value. Simply put, stocks with a zacks rank of 1, 2, or 3, with a positive esp were shown to positively surprise 70% of the time. The stock holds a p/e ratio of 9.03, while its industry has an average p/e of 11.56. The sole determinant of the zacks rating is a company's changing earnings picture. Zacks zacks is the leading investment research firm focusing on stock research, analysis and recommendations. Their forecasts range from $54.00 to $54.00.

Over the past 52 weeks, vwagy's forward p/e has been as high as 14.65 and as low as 7.11, with a median of 9.08. The zacks rank system ranges from # 1 (strong buy) to # 5 (strong sell) and has a proven, externally audited track record of outperforming, with the # 1 stocks returning an average of + 25% annually since 1988. Volkswagen ag (vwagy) stock sinks as market gains: Volkswagen ag (vwagy) has been upgraded to a zacks rank #2 (buy), reflecting growing optimism about the company's earnings prospects. The stock is trading with a p/e ratio of 8.90, which compares to its industry's average of 10.95. A rank of 35 means that 65% of stocks appear. Vwagy is currently sporting a zacks rank of #2 (buy) and an a for value.

Vwagy Has Been Given A Rating Of Strong Buy By Zacks - The Union Journal

Volkswagen Vwagy To Set Up 164m Ev Battery Plant In Hefei - September 24 2021 - Zackscom

Volkswagen Increases Production Target For Electric Cars Investingcom

Volkswagen Vwagy Battles Massive Semiconductor Supply Deficit

Should Value Investors Pick Volkswagen Vwagy Stock Now

Volkswagen Ag Vwagy Stock Sinks As Market Gains What You Should Know

0 Response to "Vwagy Stock Forecast Zacks"

Post a Comment